Danville City Manager Ken Larking tonight submitted to the City Council a proposed budget that includes $8 million in new revenue anticipated from state-collected gaming taxes and a $4.1 million local supplement from Caesars Virginia, which will open a temporary casino this year.

The gaming tax revenue, as proposed, will pay for several activities, including economic development initiatives, new positions for Danville Public Schools, maintaining low school classroom sizes, lease and debt payments for the new police headquarters, removal of blight, and continuation of the gang prevention program.

The local supplement will be used for general governmental operations, the cost of which is increasing due to inflation and rising personnel costs, including health care and salaries and wages.

The budget includes no increase in real estate, meals, and lodging tax rates. Minor utility rate adjustments are proposed. The rate adjustments are from a biennial rate study. For the average residential customer, their monthly utility bill will go up $1.50.

A monthly sanitation fee increase of $1 from $16.50 to $17.50 is proposed because of rising costs of service. The fee change is the first since 2005.

Other fee increases are proposed for parks and recreation rentals, zoning verification letters, and the fire marshal’s office. These fees capture revenue from the customers who are using these services and reduce the subsidies that the general taxpayer provides.

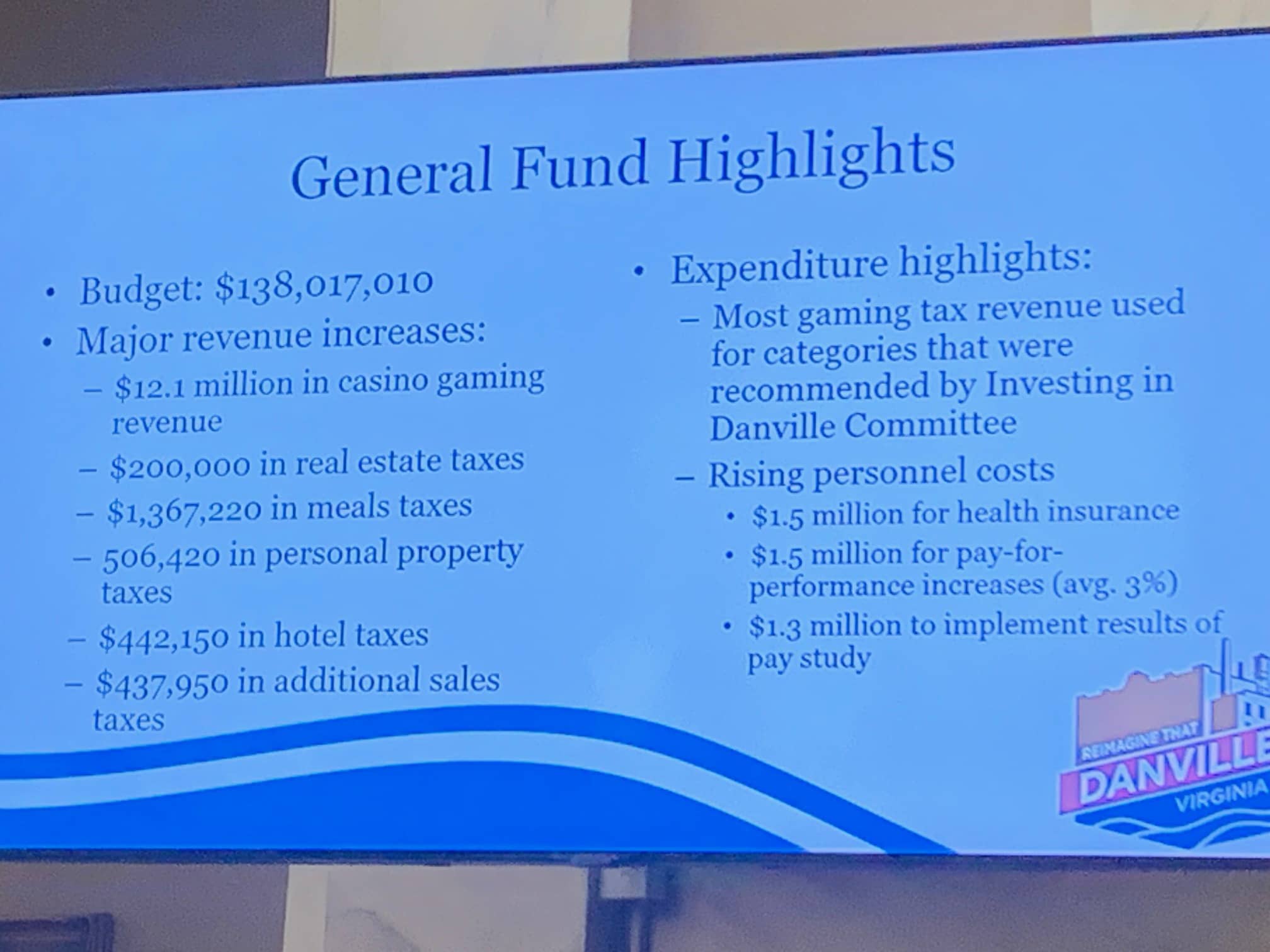

The total proposed budget for the next fiscal year is nearly $322.7 million for operations, capital improvements, and debt service. This total is a 13 percent increase, or $37 million more than the current fiscal year’s budget of $285.7 million.

The proposed budget is a working draft for the next fiscal year, which begins July 1. The City Council will hold public hearings prior to adopting a budget. Final adoption must take place no later than June 30.

Budget documents are available for review at www.danvilleva.gov/2024budget.

Revenue forecasts

Larking told the City Council that revenue forecasts are favorable as compared to last year. Those increases include:

- $12.1 million in casino gaming and supplemental revenue.

- $1.37 million in meals taxes.

- $1.17 million in business licenses.

- $506,420 million in personal property taxes.

- $437,950 in sales taxes.

- $442,150 in hotel/motel taxes

- $200,000 in current and delinquent real estate tax collections.

Expenditure highlights

The guiding principles for development of the proposed budget include a focus on the City Council-identified priority areas of economic and community development, education, and public safety.

For economic and community development, the proposed budget includes money for improvements to the Danville Regional Airport; various economic development grant programs; already-approved economic development incentives and investments in sites and buildings; phase one of a splash pad for Ballou Park Recreation Center; neighborhood revitalization efforts; Riverwalk Trail improvements; tourism marketing; and continuation of the youth Experience Works Internship Program.

For education, the proposed budget includes an increase of $2.55 million for school operations, which will be used for three new behavioral specialist positions and salary increases. These funds will help Danville Public Schools maintain low classroom sizes, which is necessary to improve student achievement.

For public safety, the proposed budget includes funds to continue implementation of the federal comprehensive gang model; expand the video surveillance program; and continue community engagement efforts, including dedicated youth engagement officers for the Police Department.

The proposed budget provides funds for rising health care costs, continues the pay-for-performance system for employee raises; funds a full year of the cost to implement the state’s minimum wage; and sets aside $1.3 million for implementation of recommendations from a pay study, which was initiated earlier this year and is nearly complete.

As proposed, four new positions will be created, and eight existing positions will be reclassified.

The proposed budget reflects an additional $19.9 million for utilities operations, which includes electric, gas, water treatment, wastewater treatment and broadband services. The increase includes $10 million in power supply costs, driven in part by servicing large customers such as Aerofarms and Tyson Foods. Those companies are expected to be a full production in the next fiscal year.